Disaster Tech Gets White-Glove Cap Table Support

“We needed an expert to help manage our ownership data”

White-glove cap table management

Disaster Tech optimizes employee ownership with the Astrella platform

Introduction

Starting a business is hard. In addition to building a solution and bringing it to market, founders and CEOs need to wear many hats and be experts in legal, tax, HR, international requirements, marketing, communications, and so much more. Managing the company’s cap table and employee stock plan is complex, highly confidential, and just can’t be wrong.

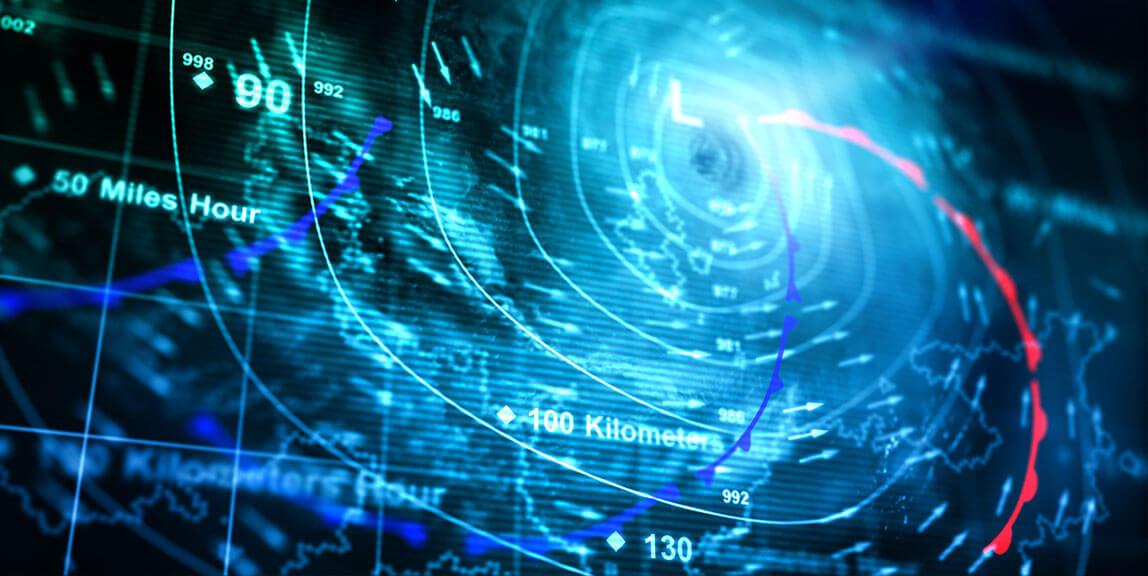

Sean Griffin, co-founder and CEO of disaster recovery service provider Disaster Technologies, Inc. (aka Disaster Tech), knows this all too well. A fast-growing startup in a highly competitive industry, their goal is to stay in line with financial obligations without compromising business agility or transparency for employees and stockholders. To manage this task, they turned to AST Private Company Solutions and their cap table management solution, Astrella.